In addition, any stockholder who intends to submit a proposal for consideration at our 20102013 Annual Meeting, but not for inclusion in our proxy materials, or who intends to submit nominees for election as directors at the meeting must notify our Corporate Secretary. Under our By-Laws, such notice must (1) be received at our executive offices no earlier than November 9, 200911, 2012 or later than January 8, 201010, 2013, and (2) satisfy specified requirements. A copy of the pertinent By-Law provisions can be found on our Web site atwww.mcdermott.comat “Corporate“About Us — Leadership & Corporate Governance — Governance Policies.Corporate Governance.”

By Order of the Board of Directors,

Secretary

Dated: March 27, 2009

65

SecretaryAPPENDIX A

2009 MCDERMOTT INTERNATIONAL, INC.

LONG-TERM INCENTIVE PLAN

ARTICLE I

Establishment, Objectives and Duration

1.1 Establishment of the Plan. McDermott International, Inc., a corporation organized and existing under the laws of the Republic of Panama (hereinafter referred to as the “Company”), hereby establishes an incentive compensation plan to be known as the 2009 McDermott International, Inc. Long-Term Incentive Plan (hereinafter referred to as this “Plan”), as set forth in this document. This Plan permits the grant of Nonqualified Stock Options, Incentive Stock Options, Restricted Stock, Restricted Stock Units, Performance Shares and Performance Units (each as hereinafter defined).

Subject to approval by the Company’s stockholders, this Plan shall become effective as of May 8, 2009 (the “Effective Date”) and shall remain in effect as provided in Section 1.3 hereof.

1.2 Objectives. This Plan is designed to promote the success and enhance the value of the Company by linking the personal interests of Participants (as hereinafter defined) to those of the Company’s stockholders, and by providing Participants with an incentive for outstanding performance. This Plan is further intended to provide flexibility to the Company in its ability to motivate, attract and retain the employmentand/or services of Participants.

1.3 Duration. This Plan, as amended and restated, shall commence on the Effective Date, as described in Section 1.1 hereof, and shall remain in effect, subject to the right of the Board of Directors (as hereinafter defined) to amend or terminate this Plan at any time pursuant to Article 15 hereof, until all Shares (as hereinafter defined) subject to it shall have been purchased or acquired according to this Plan’s provisions; provided, however, that in no event may an Award (as hereinafter defined) be granted under this Plan on or after May 8, 2019.

ARTICLE 2

Definitions

As used in this Plan, the following terms shall have the respective meanings set forth below:

2.1 “Award”means a grant under this Plan of any Nonqualified Stock Option, Incentive Stock Option, Restricted Stock, Restricted Stock Unit, Performance Share or Performance Unit.

2.2 “Award Agreement”means an agreement entered into by the Company and a Participant, setting forth the terms and provisions applicable to an Award granted under this Plan.

2.3 “Award Limitations”has the meaning ascribed to such term in Section 4.2.

2.4 “Beneficial Owner”or“Beneficial Ownership”shall have the meaning ascribed to such term inRule 13d-3 of the General Rules and Regulations under the Exchange Act.

2.5 “Board”or“Board of Directors”means the Board of Directors of the Company.

2.6 “Change in Control”means the occurrence or existence of any of the following facts or circumstances after the Effective Date:

(a) Any person (other than a trustee or other fiduciary holding securities under an Employee benefit plan of the Company or a corporation or other entity owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of stock of the Company) is or becomes the Beneficial Owner, directly or indirectly, of securities of the Company representing thirty percent (30%) or more of the combined voting power of the Company’s then outstanding voting securities;

A-1

APPENDIX A

(b) Within any period of two (2) consecutive years (not including any period prior to the Effective Date), individuals who at the beginning of such period constitute the Board, and any new Directors (other than a Director designated by a Person who has entered into an agreement with the Company to effect any transaction described in Clause (a), (c), (d) or (e) of this Section 2.6) whose election by the Board or nomination for election by the stockholders of the Company, was approved by a vote of at least two-thirds (2/3) of the Directors, then still in office who either were Directors at the beginning of the period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority of the Board;

(c) A merger or consolidation of the Company, with any other corporation or other entity has been consummated, other than a merger or consolidation which results in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least fifty percent (50%) of the combined voting power of the voting securities of the Company or the surviving entity outstanding immediately after such merger or consolidation;

(d) The shareholders of the Company approve: (i) a plan of complete liquidation of the Company; or (ii) an agreement for the sale or disposition by the Company of all or substantially all of the Company’s assets; or

(e) Within one year following the consummation of a merger or consolidation transaction involving the Company (whether as a constituent corporation, the acquiror, the direct or indirect parent entity of the acquiror, the entity being acquired, or the direct or indirect parent entity of the entity being acquired): (i) individuals who, at the time of the execution and delivery of the definitive agreement pursuant to which such transaction has been consummated by the parties thereto (a “Definitive Transaction Agreement”) (or, if there are multiple such agreements relating to such transaction, the first time of execution and delivery by the parties to any such agreement) (the “Execution Time”), constituted the Board cease, for any reason (excluding death, disability or voluntary resignation but including any such voluntary resignation effected in accordance with any Definitive Transaction Agreement), to constitute a majority of the Board; or (ii) either individual who, at the Execution Time, served as the Chief Executive Officer or Chief Financial Officer of the Company does not, for any reason (excluding as a result of death, disability or voluntary termination but including any such voluntary termination effected in accordance with any Definitive Transaction Agreement), serve as the Chief Executive Officer or Chief Financial Officer, as applicable, of the Company or, if the Company does not continue as a registrant with a class of equity securities registered pursuant to Section 12(b) of the Exchange Act, as the Chief Executive Officer or Chief Financial Officer, as applicable, of a corporation or other entity that is (A) a registrant with a class of equity securities registered pursuant to Section 12(b) of the Exchange Act and (B) the surviving entity in such transaction or a direct or indirect parent entity of the surviving entity or the Company following the consummation of such transaction; provided, however, that a Change in Control shall not be deemed to have occurred pursuant to this clause (e) in the case of a merger or consolidation which results in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 55% of the combined voting power of the voting securities of the Company or the surviving entity outstanding immediately after such merger or consolidation.

However, in no event shall a “Change in Control” be deemed to have occurred with respect to a Participant if the Participant is part of the purchasing group which consummates a transaction resulting in aChange-in-Control. A Participant shall be deemed “part of a purchasing group” for purposes of the preceding sentence if the Participant is an equity participant in the purchasing company or group (except for: (i) passive ownership of less than three percent (3%) of the stock of the purchasing company; or (ii) ownership of equity participation in the purchasing company or group which is otherwise not significant, as determined prior to the Change in Control by a majority of the non-employee continuing Directors).

2.7 “Code”means the Internal Revenue Code of 1986, as amended from time to time.

A-2

APPENDIX A

2.8 “Committee”means the Compensation Committee of the Board, or such other committee of the Board appointed by the Board to administer this Plan (or the entire Board if so designated by the Board by written resolution), as specified in Article 3 hereof.

2.9 “Company”means McDermott International, Inc., a corporation organized and existing under the laws of the Republic of Panama, and, except where the context otherwise indicates, shall include the Company’s Subsidiaries and, except with respect to the definition of “Change in Control” set forth above and the application of any defined terms used in such definition, any successor to any of such entities as provided in Article 18 hereof.

2.10 “Consultant”means a natural person who is neither an Employee nor a Director and who performs services for the Company or a Subsidiary pursuant to a contract, provided that those services are not in connection with the offer or sale of securities in a capital-raising transaction and do not directly or indirectly promote or maintain a market for the Company’s securities.

2.11 “Director”means any individual who is a member of the Board of Directors;provided, however, that any member of the Board of Directors who is employed by the Company shall be considered an Employee under this Plan.

2.12 “Disability”in the case of an Employee, shall have the meaning ascribed to such term in the Participant’s governing long-term disability plan and, in the case of a Director or Consultant, shall mean a permanent and total disability within the meaning of Section 22 (e)(3) of the Code, as determined by the Committee in good faith, upon receipt of medical advice that the Committee deems sufficient and competent, from one or more individuals selected by the Committee who are qualified to provide professional medical advice.

2.13 “Effective Date”shall have the meaning ascribed to such term in Section 1.1 hereof.

2.14 “Employee”means any person who is employed by the Company.

2.15 “Exchange Act”means the Securities Exchange Act of 1934, as amended from time to time.

2.16 “ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time.

2.17 “Fair Market Value”of a Share shall mean, as of a particular date, (a) if Shares are listed on a national securities exchange, the closing sales price per Share on the consolidated transaction reporting system for the principal national securities exchange on which Shares are listed on that date, or, if no such sale is so reported on that date, on the last preceding date on which such a sale was so reported, (b) if no Shares are so listed but are traded on an over-the-counter market, the mean between the closing bid and asked prices for Shares on that date, or, if there are no such quotations available for that date, on the last preceding date for which such quotations are available, as reported by the National Quotation Bureau Incorporated, or (c) if no Shares are publicly traded, the most recent value determined by an independent appraiser appointed by the Company for that purpose.

2.18 “Fiscal Year”means the year commencing January 1 and ending December 31.

2.19 “Incentive Stock Option”or“ISO”means an Option to purchase Shares granted under Article 6 hereof and which is designated as an Incentive Stock Option and is intended to meet the requirements of Code Section 422, or any successor provision.

2.20 “Named Executive Officer”means a Participant who, as of the date of vestingand/or payout of an award is one of the group of “covered employees” as defined in Section 162(m) of the Code and the regulations promulgated thereunder.

2.21 “Nonqualified Stock Option”or“NQSO”means an option to purchase Shares granted under Article 6 hereof and which is not an Incentive Stock Option.

2.22 “Officer”means an Employee of the Company included in the definition of “Officer” under Section 16 of the Exchange Act and rules and regulations promulgated thereunder or such other Employees who are designated as “Officers” by the Board.

A-3

APPENDIX A

2.23 “Option”means an Incentive Stock Option or a Nonqualified Stock Option.

2.24 “Option Price”means the price at which a Share may be purchased by a Participant pursuant to an Option, as determined by the Committee.

2.25 “Participant”means an eligible Officer, Director, Consultant or Employee who has been selected for participation in this Plan in accordance with Section 5.2.

2.26 “Performance-Based Award”means an Award that is designed to qualify for the Performance-Based Exception.

2.27 “Performance-Based Exception”means the performance-based exception from the deductibility limitations of Code Section 162(m).

2.28 “Performance Period”means, with respect to a Performance-Based Award, the period of time during which the performance goals specified in such Award must be met in order to determine the degree of payoutand/or vesting with respect to that Performance-Based Award.

2.29 “Performance Share”means an Award designated as such and granted to an Employee, as described in Article 8 hereof.

2.30 “Performance Unit”means an Award designated as such and granted to an Employee, as described in Article 8 herein.

2.31 “Period of Restriction”means the period during which the transfer of Shares of Restricted Stock is limited in some way (based on the passage of time, the achievement of performance goals, or upon the occurrence of other events as determined by the Committee, in its sole discretion) as set forth in the related Award Agreement,and/or the Shares are subject to a substantial risk of forfeiture, as provided in Article 7 hereof.

2.32 “Person”shall have the meaning ascribed to such term in Section 3(a)(9) of the Exchange Act and used in Section 13(d) and 14(d) thereof, including a “group” (as that term is used in Section 13(d)(3) thereof).

2.33 “Restricted Stock”means an Award designated as such and granted to a Participant pursuant to Article 7 hereof.

2.34 “Restricted Stock Unit”or“RSU”means a contractual promise to distribute to a Participant one Share or cash equal to the Fair Market Value of one Share, determined in the sole discretion of the Committee, which shall be delivered to the Participant upon satisfaction of the vesting and any other requirements set forth in the related Award Agreement.

2.35 “Retirement”shall have the meaning ascribed to such term by the Committee, as set forth in the applicable Award Agreement.

2.36 “Shares”means the common stock, par value $1.00 per share, of the Company.

2.37 “Subsidiary”means any corporation, partnership, joint venture, affiliate or other entity in which the Company has a majority voting interest and which the Committee designates as a participating entity in this plan.

2.38 “Vesting Period”means the period during which an Award granted hereunder is subject to a service or performance-related restriction, as set forth in the related Award Agreement.

A-4

APPENDIX A

ARTICLE 3

Administration

3.1 The Committee. This Plan shall be administered by the Committee. The members of the Committee shall be appointed from time to time by, and shall serve at the discretion of, the Board of Directors.

3.2 Authority of the Committee. Except as limited by law or by the Articles of Incorporation or Amended and Restated By-Laws of the Company (each as amended from time to time), the Committee shall have full and exclusive power and authority to take all actions specifically contemplated by this Plan or that are necessary or appropriate in connection with the administration hereof and shall also have full and exclusive power and authority to interpret this Plan and to adopt such rules, regulations and guidelines for carrying out this Plan as the Committee may deem necessary or proper. The Committee shall have full power and sole discretion to: select Officers, Directors, Consultants and Employees who shall be granted Awards under this Plan; determine the sizes and types of Awards; determine the time when Awards are to be granted and any conditions that must be satisfied before an Award is granted; determine the terms and conditions of Awards in a manner consistent with this Plan; determine whether the conditions for earning an Award have been met and whether a Performance-Based Award will be paid at the end of an applicable performance period; determine the guidelinesand/or procedures for the payment or exercise of Awards; and determine whether a Performance-Based Award should qualify, regardless of its amount, as deductible in its entirety for federal income tax purposes, including whether a Performance-Based Award granted to an Officer should qualify as performance-based compensation. The Committee may, in its sole discretion, accelerate the vesting or exercisability of an Award, eliminate or make less restrictive any restrictions contained in an Award, waive any restriction or other provision of this Plan or any Award or otherwise amend or modify any Award in any manner that is either (a) not adverse to the Participant to whom such Award was granted or (b) consented to in writing by such Participant, and (c) consistent with the requirements of Code Section 409A, if applicable. The Committee may correct any defect or supply any omission or reconcile any inconsistency in this Plan or in any Award in the manner and to the extent the Committee deems necessary or desirable to further this Plan’s objectives. Further, the Committee shall make all other determinations that may be necessary or advisable for the administration of this Plan. As permitted by law and the terms of this Plan, the Committee may delegate its authority as identified herein.

3.3 Delegation of Authority. To the extent permitted under applicable law, the Committee may delegate to the Chief Executive Officer and to other senior officers of the Company its duties under this Plan pursuant to such conditions or limitations as the Committee may establish; provided however, the Committee may not delegate any authority to grant Awards to a Director.

3.4 Decisions Binding. All determinations and decisions made by the Committee pursuant to the provisions of this Plan and all related orders and resolutions of the Committee shall be final, conclusive and binding on all persons concerned, including the Company, its stockholders, Officers, Directors, Employees, Consultants, Participants and their estates and beneficiaries.

ARTICLE 4

Shares Subject to this Plan

4.1 Number of Shares Available for Grants of Awards. Subject to adjustment as provided in Section 4.3 hereof, there is reserved for issuance of Awards under this Plan nine million (9,000,000) Shares. Shares subject to Awards under this Plan that are cancelled, forfeited, terminated or expire unexercised, shall immediately become available for the granting of Awards under this Plan. Additionally, Shares approved pursuant to the 2001 Directors and Officers Long Term Incentive Plan which have not been awarded as of the Effective Date, or are subject to awards that are canceled, terminated, forfeited, expire unexercised, are settled in cash in lieu of Shares, or are exchanged for consideration that does not involve Shares will immediately become available for Awards. The Committee may from time to time adopt and observe such procedures concerning the counting of Shares against this Plan maximum as it may deem appropriate.

A-5

APPENDIX A

4.2 Limits on Grants in Any Fiscal Year. The following rules (“Award Limitations”) shall apply to grants of Awards under this Plan:

(a) Options. The maximum aggregate number of Shares issuable pursuant to Awards of Options that may be granted in any one Fiscal Year of the Company to any one Participant shall be one million two hundred thousand (1,200,000).

(b) Restricted Stock and Restricted Stock Units. The maximum aggregate number of Shares subject to Awards of Restricted Stock and RSUs that may be granted in any one Fiscal Year to any one Participant shall be one million two hundred thousand (1,200,000).

(c) Performance Shares. The maximum aggregate number of Shares subject to Awards of Performance Shares that may be granted in any one Fiscal Year to any one Participant shall be one million two hundred thousand (1,200,000).

(d) Performance Units. The maximum aggregate cash payout with respect to Performance Units granted in any one Fiscal Year to any one Participant shall be six million dollars ($6,000,000), with such cash value determined as of the date of each grant.

4.3 Adjustments in Authorized Shares. The existence of outstanding Awards shall not affect in any manner the right or power of the Company or its stockholders to make or authorize any or all adjustments, recapitalizations, reorganizations or other changes in the capital stock of the Company or its business or any merger or consolidation of the Company, or any issue of bonds, debentures, preferred or prior preference stock (whether or not such issue is prior to, on a parity with or junior to the Shares) or the dissolution or liquidation of the Company, or any sale or transfer of all or any part of its assets or business or any other corporate act or proceeding of any kind, whether or not of a character similar to that of the acts or proceedings enumerated above.

If there shall be any change in the Shares of the Company or the capitalization of the Company through merger, consolidation, reorganization, recapitalization, stock dividend, stock split, reverse stock split,split-up, spin-off, combination of shares, exchange of shares, dividend in kind or other like change in capital structure or distribution (other than normal cash dividends) to stockholders of the Company, the Committee, in its sole discretion, in order to prevent dilution or enlargement of Participants’ rights under this Plan, shall adjust, in such manner as it deems equitable, as applicable, the number and kind of Shares that may be granted as Awards under this Plan, the number and kind of Shares subject to outstanding Awards, the exercise or other price applicable to outstanding Awards, the Awards Limitations, the Fair Market Value of the Shares and other value determinations applicable to outstanding Awards;provided, however, that the number of Shares subject to any Award shall always be a whole number. In the event of a corporate merger, consolidation, acquisition of property or stock, separation, reorganization or liquidation, the Committee shall be authorized, in its sole discretion, to: (a) grant or assume Awards by means of substitution of new Awards, as appropriate, for previously granted Awards or to assume previously granted Awards as part of such adjustment; (b) make provision, prior to the transaction, for the acceleration of the vesting and exercisability of, or lapse of restrictions with respect to, Awards and the termination of Options that remain unexercised at the time of such transaction; (c) provide for the acceleration of the vesting and exercisability of Options and the cancellation thereof in exchange for such payment as the Committee, in its sole discretion, determines is a reasonable approximation of the value thereof; (d) cancel any Awards and direct the Company to deliver to the Participants who are the holders of such Awards cash in an amount that the Committee shall determine in its sole discretion is equal to the fair market value of such Awards as of the date of such event, which, in the case of any Option, shall be the amount equal to the excess of the Fair Market Value of a Share as of such date over the per-share exercise price for such Option (for the avoidance of doubt, if such exercise price is less than such Fair Market Value, the Option may be canceled for no consideration); or (e) cancel Awards that are Options and give the Participants who are the holders of such Awards notice and opportunity to exercise prior to such cancellation.

A-6

APPENDIX A

ARTICLE 5

Eligibility and Participation

5.1 Eligibility. Persons eligible to participate in this Plan include all Officers, Directors, Employees and Consultants, as determined in the sole discretion of the Committee.

5.2 Actual Participation. Subject to the provisions of this Plan, the Committee may, from time to time, select from all Officers, Directors, Employees and Consultants, those to whom Awards shall be granted and shall determine the nature and amount of each Award. No Officer, Director, Employee or Consultant shall have the right to be selected for Participation in this Plan, or, having been so selected, to be selected to receive a future award.

ARTICLE 6

Options

6.1 Grant of Options. Subject to the terms and provisions of this Plan, Options may be granted to Participants in such number, upon such terms, at any time, and from time to time, as shall be determined by the Committee;provided, however,that ISOs may be awarded only to Employees. Subject to the terms of this Plan, the Committee shall have discretion in determining the number of Shares subject to Options granted to each Participant.

6.2 Option Award Agreement. Each Option grant shall be evidenced by an Award Agreement that shall specify the Option Price, the duration of the Option, the number of Shares to which the Option pertains, and such other provisions as the Committee shall determine that are not inconsistent with the terms of this Plan. The Award Agreement also shall specify whether the Option is intended to be an ISO or an NQSO (provided that, in the absence of such specification, the Option shall be an NQSO).

6.3 Option Price. The Option Price for each grant of an Option under this Plan shall be as determined by the Committee;provided, however, that, subject to any subsequent adjustment that may be made pursuant to the provisions of Section 4.3 hereof, the Option Price shall be not less than one hundred percent (100%) of the Fair Market Value of a Share on the date the Option is granted. Except as otherwise provided in Section 4.3 hereof, without prior stockholder approval no repricing of Options awarded under this Plan shall be permitted such that the terms of outstanding Options may not be amended to reduce the Option Price and further Options may not be replaced or regranted through cancellation, in exchange for cash, other Awards, or if the effect of the replacement or regrant would be to reduce the Option Price of the Options or would constitute a repricing under generally accepted accounting principles in the United States (as applicable to the Company’s public reporting).

6.4 Duration of Options. Subject to any earlier expiration that may be effected pursuant to the provisions of Section 4.3 hereof, each Option shall expire at such time as the Committee shall determine at the time of grant;provided, however, that an Option shall not be exercisable later than the seventh (7th) anniversary date of its grant.

6.5 Exercise of Options. Options granted under this Plan shall be exercisable at such times and be subject to such restrictions and conditions as the Committee shall in each instance approve, which need not be the same for each grant or for each Participant.

6.6 Payment. Any Option granted under this Article 6 shall be exercised by the delivery of a notice of exercise to the Company in the manner prescribed in the related Award Agreement, setting forth the number of Shares with respect to which the Option is to be exercised, and either (i) accompanied by full payment of the Option Price for the Shares issuable on such exercise or (ii) exercised in a manner that is in accordance with applicable law and the “cashless exercise” procedures (if any) approved by the Committee involving a broker or dealer.

The Option Price upon exercise of any Option shall be payable to the Company in full: (a) in cash; (b) by tendering previously acquired Shares valued at their Fair Market Value per Share at the time of exercise (provided that the Shares which are tendered must have been held by the Participant for at least six (6) months prior to their tender); (c) by a combination of (a) and (b); or (d) any other method approved by the Committee, in its sole discretion.

A-7

APPENDIX A

Subject to any governing rules or regulations, as soon as practicable after receipt of a notification of exercise and full payment, the Company shall deliver to the Participant, in the Participant’s name, Share certificates in an appropriate amount based upon the number of Shares purchased under the Option.

6.7 Restrictions on Share Transferability. The Committee may impose such restrictions on any Shares acquired pursuant to the exercise of an Option granted under this Plan as it may deem advisable, including, without limitation, restrictions under applicable U.S. federal securities laws, under the requirements of any stock exchange or market upon which such Shares are then listedand/or traded, and under any blue sky or state securities laws applicable to such Shares.

6.8 Termination of Employment, Service or Directorship. Each Option Award Agreement shall set forth the extent to which the Participant shall have the right to exercise the Option following termination of the Participant’s employment, service or directorship with the Companyand/or its Subsidiaries. Such provisions shall be determined in the sole discretion of the Committee, shall be included in each Award Agreement entered into with a Participant with respect to an Option Award, need not be uniform among all Options granted pursuant to this Article 6 and may reflect distinctions based on the reasons for termination.

6.9 Transferability of Options.

(a) Incentive Stock Options. No ISO granted under this Plan may be sold, transferred, pledged, assigned or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution or pursuant to a qualified domestic relations order as defined by the Code or Title I of ERISA, or the regulations thereunder. Further, all ISOs granted to a Participant under this Plan shall be exercisable during his or her lifetime only by such Participant.

(b) Nonqualified Stock Options. Except as otherwise provided in a Participant’s Award Agreement, NQSOs granted under this Plan may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution or pursuant to a qualified domestic relations order as defined by the Code or Title I of ERISA, or the regulations thereunder. Further, except as otherwise provided in a Participant’s Award Agreement, all NQSOs granted to a Participant under this Plan shall be exercisable during his or her lifetime only by such Participant.

ARTICLE 7

Restricted Stock

7.1 Grant of Restricted Stock. Subject to the terms and provisions of this Plan, the Committee at any time, and from time to time, may grant Shares as Restricted Stock (“Shares of Restricted Stock”) to Participants in such amounts as the Committee shall determine.

7.2 Restricted Stock Award Agreement. Each Award of Restricted Stock shall be evidenced by an Award Agreement that shall specify the Period of Restriction, the number of Shares of Restricted Stock granted, and such other provisions as the Committee shall determine.

7.3 Transferability. Except as provided in the Participant’s related Award Agreementand/or this Article 7, the Shares of Restricted Stock granted to a Participant under this Plan may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated until the end of the applicable Period of Restriction established by the Committee and specified in the related Award Agreement entered into with that Participant, or upon earlier satisfaction of any other conditions, as specified by the Committee in its sole discretion and set forth in the Award Agreement. During the applicable Period of Restriction, all rights with respect to the Restricted Stock granted to a Participant under this Plan shall be available during his or her lifetime only to such Participant. Any attempted assignment of Restricted Stock in violation of this Section 7.3 shall be null and void.

7.4 Other Restrictions. The Committee may impose such other conditionsand/or restrictions on any Shares of Restricted Stock granted pursuant to this Plan as it may deem advisable, including, without limitation, a requirement that Participants pay a stipulated purchase price for each Share of Restricted Stock, restrictions based

A-8

APPENDIX A

upon the achievement of specific performance goals, time-based restrictions on vesting following the attainment of the performance goalsand/or restrictions under applicable U.S. federal or state securities laws.

To the extent deemed appropriate by the Committee, the Company may retain the certificates representing Shares of Restricted Stock in the Company’s possession until such time as all conditionsand/or restrictions applicable to such Shares have been satisfied or have lapsed.

7.5 Removal of Restrictions. Except as otherwise provided in this Article 7, Shares of Restricted Stock covered by each Restricted Stock Award made under this Plan shall become freely transferable by the Participant after all conditions and restrictions applicable to such Shares have been satisfied or have lapsed.

7.6 Voting Rights. To the extent permitted by the Committee or required by law, Participants holding Shares of Restricted Stock granted hereunder may exercise full voting rights with respect to those Shares during the applicable Period of Restriction.

7.7 Dividends. During the applicable Period of Restriction, Participants holding Shares of Restricted Stock granted hereunder shall, unless the Committee otherwise determines, be credited with cash dividends paid with respect to the Shares, in a manner determined by the Committee in its sole discretion. The Committee may apply any restrictions to the dividends that it deems appropriate.

7.8 Termination of Employment, Service or Directorship. Each Restricted Stock Award Agreement shall set forth the extent to which the Participant shall have the right to receive unvested Shares of Restricted Stock following termination of the Participant’s employment, service or directorship with the Companyand/or its Subsidiaries. Such provisions shall be determined in the sole discretion of the Committee, shall be included in each Award Agreement entered into with a Participant with respect to Shares of Restricted Stock, need not be uniform among all Shares of Restricted Stock granted pursuant to this Article 7 and may reflect distinctions based on the reasons for termination.

ARTICLE 8

Performance Units and Performance Shares

8.1 Grant of Performance Units/Shares. Subject to the terms of this Plan, Performance Units and Performance Shares may be granted to Participants in such amounts and upon such terms, and at any time and from time to time, as shall be determined by the Committee.

8.2 Value of Performance Units/Shares. Each Performance Unit shall have an initial value that is established by the Committee at the time of grant. Each Performance Share shall have an initial value equal to one hundred percent (100%) of the Fair Market Value of a Share on the date of grant. The Committee shall set performance goals in its discretion that, depending on the extent to which they are met, will determine the numberand/or value of Performance Units/Shares which will be paid out to the Participant.

8.3 Earning of Performance Units/Shares. Subject to the terms of this Plan, after the applicable Performance Period has ended, the holder of Performance Units/Shares shall be entitled to receive payment of the number and value of Performance Units/Shares earned by the Participant over the Performance Period, to be determined as a function of the extent to which the corresponding performance goals have been achieved.

8.4 Form and Timing of Payment of Performance Units/Shares. Subject to the provisions of Article 12 hereof, Payment of earned Performance Units/Shares to a Participant shall be made no later than March 15 following the end of the calendar year in which such Performance Units/Shares vest, or as soon as administratively practicable thereafter if payment is delayed due to unforeseeable events. Subject to the terms of this Plan, the Committee, in its sole discretion, may pay earned Performance Units/Shares in the form of cash or in Shares (or in a combination thereof) that have an aggregate Fair Market Value equal to the value of the earned Performance Units/Shares at the close of the applicable Performance Period. Any Shares issued or transferred to a Participant for this purpose may be granted subject to any restrictions that are deemed appropriate by the Committee.

A-9

APPENDIX A

8.5 Termination of Employment, Service or Directorship. Each Award Agreement providing for a Performance Unit/Share shall set forth the extent to which the Participant shall have the right to receive a payout of cash or Shares with respect to unvested Performance Unit/Shares following termination of the Participant’s employment, service or directorship with the Companyand/or its Subsidiaries. Such provisions shall be determined in the sole discretion of the Committee, shall be included in the Award Agreement entered into with the Participant, need not be uniform among all Awards of Performance Units/Shares granted pursuant to this Article 8 and may reflect distinctions based on the reasons for termination.

8.6 Transferability. Except as otherwise provided in a Participant’s related Award Agreement, Performance Units/Shares may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution or pursuant to a qualified domestic relations order as defined by the Code or Title I of ERISA, or the regulations thereunder. Further, except as otherwise provided in a Participant’s related Award Agreement, a Participant’s rights with respect to Performance Units/Shares granted to that Participant under this Plan shall be exercisable during the Participant’s lifetime only by the Participant. Any attempted assignment of Performance Units/Shares in violation of this Section 8.6 shall be null and void.

ARTICLE 9

Restricted Stock Units

9.1 Grant of RSUs. Subject to the terms and provisions of this Plan, the Committee at any time, and from time to time, may grant RSUs to eligible Participants in such amounts as the Committee shall determine.

9.2 RSU Award Agreement. Each RSU Award to a Participant shall be evidenced by an RSU Award Agreement entered into with that Participant, which shall specify the Vesting Period, the number of RSUs granted, and such other provisions as the Committee shall determine in its sole discretion.

9.3 Transferability. Except as provided in a Participant’s related Award Agreement, RSUs granted hereunder may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution or pursuant to a qualified domestic relations order as defined by the Code or Title I of ERISA, or the regulations thereunder. Further, except as otherwise provided in a Participant’s related Award Agreement, a Participant’s rights with respect to an RSU Award granted to that Participant under this Plan shall be available during his or her lifetime only to such Participant. Any attempted assignment of an RSU Award in violation of this Section 9.3 shall be null and void.

9.4 Form and Timing of Delivery. If a Participant’s RSU Award Agreement provides for payment in cash, payment equal to the Fair Market Value of the Shares underlying the RSU Award, calculated as of the last day of the applicable Vesting Period, shall be made in a single lump-sum payment. If a Participant’s RSU Award Agreement provides for payment in Shares, the Shares underlying the RSU Award shall be delivered to the Participant. Such payment of cash or Shares shall be made no later than March 15 following the end of the calendar year during which the RSU Award vests, or as soon as practicable thereafter if payment is delayed due to unforeseeable events. Such delivered Shares shall be freely transferable by the Participant.

9.5 Voting Rights and Dividends. During the applicable Vesting Period, Participants holding RSUs shall not have voting rights with respect to the Shares underlying such RSUs. During the applicable Vesting Period, Participants holding RSUs granted hereunder shall, unless the Committee otherwise determines, be credited with dividend equivalents, in the form of cash or additional RSUs (as determined by the Committee in its sole discretion), if a cash dividend is paid with respect to the Shares. The extent to which dividend equivalents shall be credited shall be determined in the sole discretion of the Committee. Such dividend equivalents shall be subject to a Vesting Period equal to the remaining Vesting Period of the RSUs with respect to which the dividend equivalents are paid.

9.6 Termination of Employment, Service or Directorship. Each RSU Award Agreement shall set forth the extent to which the applicable Participant shall have the right to receive a payout of cash or Shares with respect to unvested RSUs following termination of the Participant’s employment, service or directorship with the Companyand/or its Subsidiaries. Such provisions shall be determined in the sole discretion of the Committee, shall be

A-10

APPENDIX A

included in each Award Agreement entered into with a Participant with respect to RSUs, need not be uniform among all RSUs granted pursuant to this Article 9 and may reflect distinctions based on the reasons for termination.

ARTICLE 10

Performance Measures

10.1 Performance Measures. Unless and until the Committee proposes and shareholders approve a change in the general performance measures set forth in this Article 10, the attainment of which may determine the degree of payoutand/or vesting with respect to Awards to Named Executive Officers which are designed to qualify for the Performance-Based Exception, the performance measure(s) to be used for purposes of such grants shall be chosen from among the following alternatives:

(a) Cash Flow;

(b) Cash Flow Return on Capital;

(c) Cash Flow Return on Assets;

(d) Cash Flow Return on Equity;

(e) Net Income;

(f) Return on Capital;

(g) Return on Assets;

(h) Return on Equity;

(i) Share Price;

(j) Earnings Per Share;

(k) Earnings Before Interest and Taxes;

(l) Earnings Before Interest, Taxes, Depreciation and Amortization;

(m) Total Return to Shareholders;

(n) Operating Income; and

(o) Return on Net Assets.

Subject to the terms of this Plan, each of these measures shall be defined by the Committee on a consolidated, group or division basis or in comparison to one or more peer group companies or indices, and may include or exclude specified extraordinary items as defined by the Company’s auditors.

10.2 Adjustments. The Committee shall have the sole discretion to adjust determinations of the degree of attainment of the pre-established performance goals; provided, however, that Awards which are designed to qualify for the Performance-Based Exception and which are held by Named Executive Officers may not be adjusted upwards on a discretionary basis. The Committee shall retain the discretion to adjust such Awards downward.

10.3 Compliance with Code Section 162(m). In the event that applicable taxand/or securities laws or regulations change to permit Committee discretion to alter the governing performance measures without obtaining shareholder approval of such changes, the Committee shall have sole discretion to make such changes without obtaining shareholder approval. In addition, in the event that the Committee determines that it is advisable to grant Awards to Named Executive Officers which shall not qualify for the Performance-Based Exception, the Committee may make such grants without satisfying the requirements of Code Section 162(m) and the regulations issued thereunder. Any performance-based Awards granted to Officers or Directors that are not intended to qualify as qualified performance-based compensation under Section 162(m) of the Code shall be based on achievement of

A-11

APPENDIX A

such performance measure(s) and be subject to such terms, conditions and restrictions as the Committee shall determine.

ARTICLE 11

Beneficiary Designation

Each Participant under this Plan may, from time to time, name any beneficiary or beneficiaries (who may be named contingently or successively) to whom any benefit under this Plan is to be paid in case of the Participant’s death before he or she receives any or all of such benefit. Each such designation shall revoke all prior designations by the same Participant, shall be in a form prescribed by the Company, and will be effective only when filed by the Participant in writing with the Company during the Participant’s lifetime. In the absence of any such designation, benefits remaining unpaid at the Participant’s death shall be paid to the Participant’s estate.

ARTICLE 12

Deferrals

The Committee may, in its sole discretion, permit selected Participants to elect to defer payment of some or all types of Awards, or may provide for the deferral of an Award in an Award Agreement; provided, however, that the timing of any such election and payment of any such deferral shall be specified in the Award Agreement and shall conform to the requirements of Code Section 409A(a)(2), (3) and (4) and the regulations and rulings issued thereunder. Any deferred payment, whether elected by a Participant or specified in an Award Agreement or by the Committee, may be forfeited if and to the extent that the applicable Award Agreement so provides.

ARTICLE 13

Rights of Employees, Directors and Consultants

13.1 Employment or Service. Nothing in this Plan shall interfere with or limit in any way the right of the Company to terminate any Participant’s employment or service at any time, nor confer upon any Participant any right to continue in the employ or service of the Company.

13.2 No Contract of Employment. Neither an Award nor any benefits arising under this Plan shall constitute part of a Participant’s employment contract with the Company or any Subsidiary, and accordingly, subject to the provisions of Article 15 hereof, this Plan and the benefits hereunder may be terminated at any time in the sole and exclusive discretion of the Board without giving rise to liability on the part of the Company or any Subsidiary for severance payments.

13.3 Transfers Between Participating Entities. For purposes of this Plan, a transfer of a Participant’s employment between the Company and a Subsidiary, or between Subsidiaries, shall not be deemed to be a termination of employment. Upon such a transfer, the Committee may make such adjustments to outstanding Awards as it deems appropriate to reflect the change in reporting relationships.

ARTICLE 14

Change in Control

The treatment of outstanding Awards upon the occurrence of a Change in Control, unless otherwise specifically prohibited under applicable laws, or by the rules and regulations of any governing governmental agencies or national securities exchanges shall be determined in the sole discretion of the Committee and shall be described in the Award Agreements and need not be uniform among all Awards granted pursuant to this Plan.

A-12

APPENDIX A

ARTICLE 15

Amendment, Modification and Termination

15.1 Amendment, Modification, and Termination. The Board may at any time and from time to time, alter, amend, suspend or terminate this Plan in whole or in part,provided, however,that shareholder approval shall be required for any amendment that materially alters the terms of this Plan or is otherwise required by applicable legal requirements. No amendment or alteration that would adversely affect the rights of any Participant under any Award previously granted to such Participant shall be made without the consent of such Participant.

15.2 Adjustment of Awards Upon the Occurrence of Certain Unusual or Nonrecurring Events. The Committee may make adjustments in the terms and conditions of, and the criteria included in, Awards in recognition of unusual or nonrecurring events (including, without limitation, the events described in Section 4.3 hereof) affecting the Company or the financial statements of the Company or in recognition of changes in applicable laws, regulations or accounting principles, whenever the Committee determines that such adjustments are appropriate in order to prevent unintended dilution or enlargement of the benefits or potential benefits intended to be made available under this Plan.

ARTICLE 16

Withholding

The Company shall have the right to deduct applicable taxes from any Award payment and withhold, at the time of delivery or vesting of cash or Shares under this Plan, or at the time applicable law otherwise requires, an appropriate amount of cash or number of Shares or a combination thereof for payment of taxes required by law or to take such other action as may be necessary in the opinion of the Company to satisfy all obligations for withholding of such taxes. The Committee may permit withholding to be satisfied by the transfer to the Company of Shares theretofore owned by the holder of the Award with respect to which withholding is required. If Shares are used to satisfy tax withholding, such Shares shall be valued at their Fair Market Value on the date when the tax withholding is required to be made.

ARTICLE 17

Indemnification

Each person who is or shall have been a member of the Committee, or of the Board, or an officer of the Company to whom the Committee has delegated authority in accordance with Article 3 hereof, shall be indemnified and held harmless by the Company against and from: (a) any loss, cost, liability, or expense that may be imposed upon or reasonable incurred by him or her in connection with or resulting from any claim, action, suit or proceeding to which he or she may be a party or in which he or she may be involved by reason of any action taken or failure to act under this Plan, except for any such action or failure to act that constitutes willful misconduct on the part of such person or as to which any applicable statute prohibits the Company from providing indemnification; and (b) any and all amounts paid by him or her in settlement of any claim, action, suit or proceeding as to which indemnification is provided pursuant to clause (a) of this sentence, with the Company’s approval, or paid by him or her in satisfaction of any judgment or award in any such action, suit or proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf.

The foregoing right of indemnification shall be in addition to any other rights of indemnification to which such persons may be entitled under the Company’s Articles of Incorporation or Amended and Restated By-Laws (each, as amended from time to time), as a matter of law, or otherwise.

A-13

APPENDIX A

ARTICLE 18

Successors

All obligations of the Company under this Plan with respect to Awards granted hereunder shall be binding on any successor to the Company, whether the existence of such successor is the direct or indirect result of a merger, consolidation, purchase of all or substantially all of the businessand/or assets of the Company or other transaction.

ARTICLE 19

General Provisions

19.1 Restrictions and Legends. No Shares or other form of payment shall be issued or transferred with respect to any Award unless the Company shall be satisfied that such issuance or transfer will be in compliance with applicable U.S. federal and state securities laws. The Committee may require each person receiving Shares pursuant to an Award under this Plan to represent to and agree with the Company in writing that the Participant is acquiring the Shares for investment without a view to distribution thereof. Any certificates evidencing Shares delivered under this Plan (to the extent that such Shares are so evidenced) may be subject to such stop-transfer orders and other restrictions as the Committee may deem advisable under the rules, regulations and other requirements of the Securities and Exchange Commission, any securities exchange or transaction reporting system upon which the Shares are then listed or to which they are admitted for quotation and any applicable U.S. federal or state securities law. In addition to any other legend required by this Plan, any certificates for such Shares may include any legend that the Committee deems appropriate to reflect any restrictions on transfer of such Shares.

19.2 Gender and Number. Except where otherwise indicated by the context, any masculine term used herein also shall include the feminine, the plural shall include the singular and the singular shall include the plural.

19.3 Severability. If any provision of this Plan shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining parts of this Plan, and this Plan shall be construed and enforced as if the illegal or invalid provision had not been included.

19.4 Requirements of Law. The granting of Awards and the issuance of Shares under this Plan shall be subject to all applicable laws, rules and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

19.5 Uncertificated Shares. To the extent that this Plan provides for issuance of certificates to reflect the transfer of Shares, the transfer of such Shares may be effected on a noncertificated basis, to the extent not prohibited by applicable law or the rules of any stock exchange or transaction reporting system on which the Shares are listed or to which the Shares are admitted for quotation.

19.6 Unfunded Plan. Insofar as this Plan provides for Awards of cash, Shares or rights thereto, it will be unfunded. Although the Company may establish bookkeeping accounts with respect to Participants who are entitled to cash, Shares or rights thereto under this Plan, it will use any such accounts merely as a bookkeeping convenience. Participants shall have no right, title or interest whatsoever in or to any investments that the Company may make to aid it in meeting its obligations under this Plan. Nothing contained in this Plan, and no action taken pursuant to its provisions, shall create or be construed to create a trust of any kind, or a fiduciary relationship between the Company and any Participant, beneficiary, legal representative or any other person. To the extent that any person acquires a right to receive payments from the Company under this Plan, such right shall be no greater than the right of an unsecured general creditor of the Company. All payments to be made hereunder shall be paid from the general funds of the Company and no special or separate fund shall be established and no segregation of assets shall be made to assure payment of such amounts, except as expressly set forth in this Plan. This Plan is not intended to be subject to ERISA.

19.7 No Fractional Shares. No fractional Shares shall be issued or delivered pursuant to this Plan or any Award. The Committee shall determine whether cash, Awards or other property shall be delivered or paid in lieu of fractional Shares or whether such fractional Shares or any rights thereto shall be forfeited or otherwise eliminated.

A-14

APPENDIX A

19.8 Governing Law. This Plan and all determinations made and actions taken pursuant hereto, to the extent not otherwise governed by mandatory provisions of the Code or the securities laws of the United States, will be governed by and construed in accordance with the laws of the State of Texas, without giving effect to any conflicts of laws provisions thereof that would result in the application of the laws of any other jurisdiction.

A-15

| | |

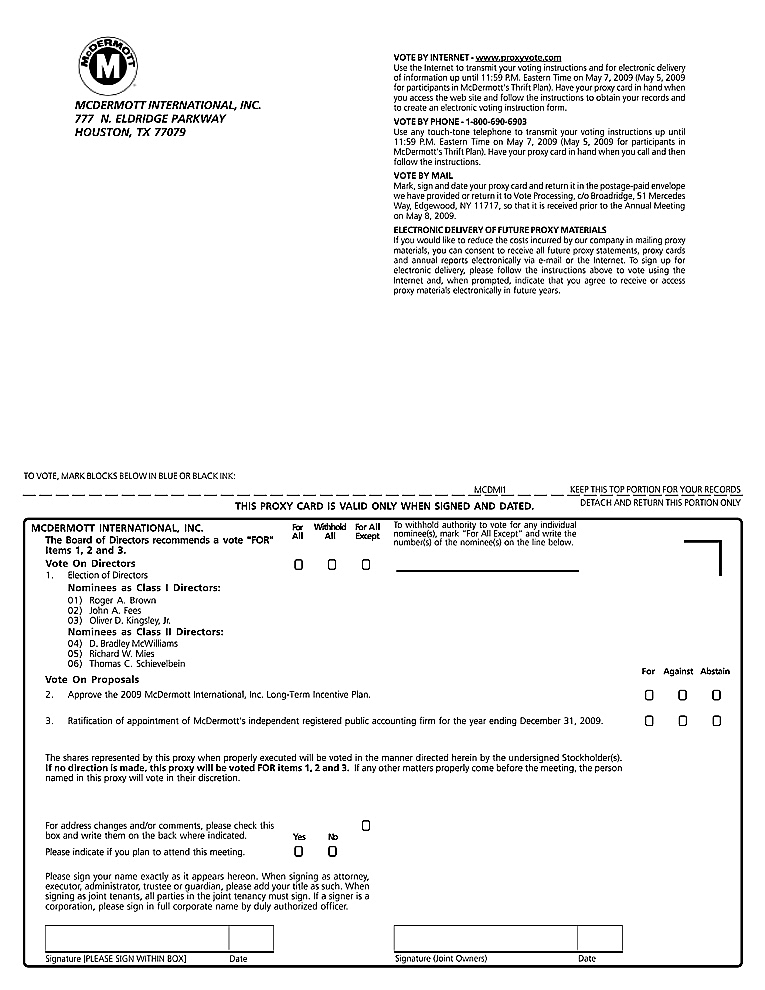

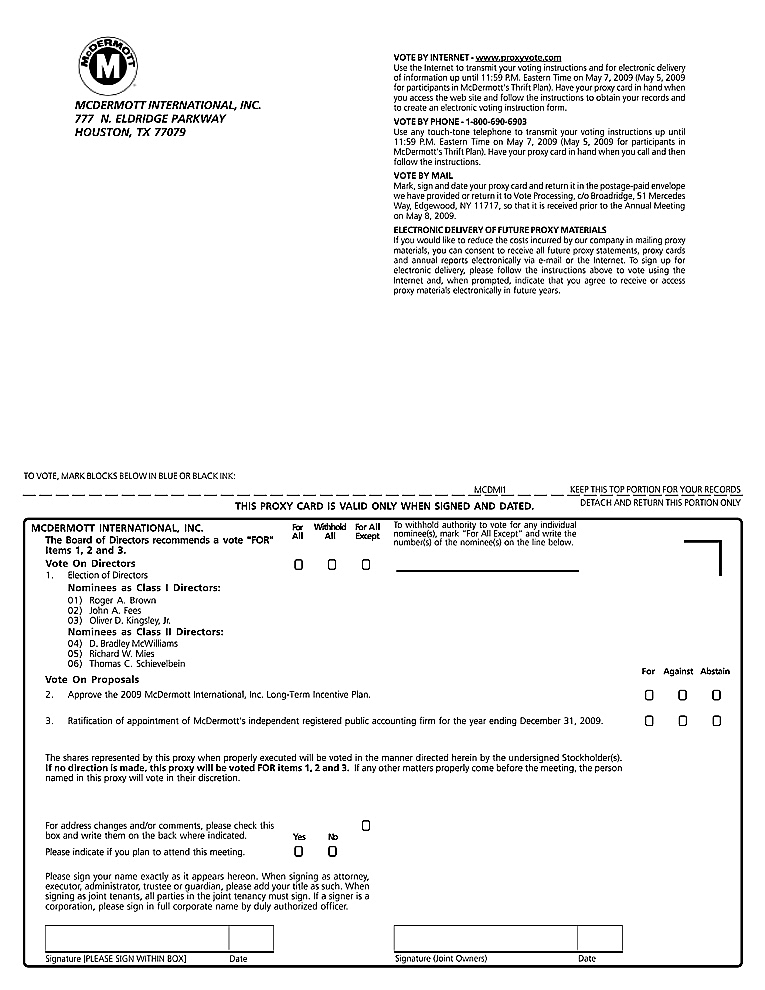

| | VOTE BY INTERNET — www.proxyvote.comUse-www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M.p.m. Eastern Time on May 9, 2012 (May 7, 2009 (May 5, 20092012 for participants in McDermott’s Thrift Plan). Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and MCDERMOTT INTERNATIONAL, INC.toto create an electronic voting instruction form.777 N. ELDRIDGE PARKWAYVOTEform. VOTE BY PHONE — 1-800-690-6903HOUSTON, TX 77079Use- 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M.p.m. Eastern Time on May 9, 2012 (May 7, 2009 (May 5, 20092012 for participants in McDermott’s Thrift Plan). Have your proxy card in hand when you call and then follow the instructions.VOTEinstructions. VOTE BY MAILMark,MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, so that it is received prior to the Annual Meeting on May 8, 2009.ELECTRONIC11717. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALSIfMATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receivereceiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK:MCDMI1KEEP THIS TOP PORTION FOR YOUR RECORDSTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.DETACH AND RETURN THIS PORTION ONLYMCDERMOTTyears. |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

M43299-P20059 KEEP THIS PORTION FOR YOUR RECORDS

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MCDERMOTT INTERNATIONAL, INC.For INC. | | For

All | | Withhold All | | For All

Except | | To withhold authority to vote for any individual All All Except nominee(s), mark “For All Except” and write theThe Board of Directors recommends a vote “FOR“the number(s) of the nominee(s) on the line below. Items 1, 2 and 3.Vote On Directors0 0 01.Election | | | | | | | | |

| | The Board of DirectorsNominees as Class I Directors:Directors recommends you vote FOR the following: | | | | | | | | | | | | | | | |

| | 1. | | Election of Directors | | ¨ | | ¨ | | ¨ | | | | | | | | | | | | |

| | | | Nominees: | | | | | | | | | | | | | | | | | | |

| | | | 01) John F. Bookout, III | | 05) D. Bradley McWilliams | | | | | | | | | | | | | | | | | | | | |

| | | | 02) Roger A. Brown 02) John A. Fees 03) Oliver D. Kingsley, Jr.Nominees as Class II Directors:04) D. Bradley McWilliams 05) Richard W. Mies | | 06) Thomas C. SchievelbeinFor Against AbstainVote On Proposals2.ApproveSchievelbein | | | | | | | | | | | | | | | | | | | | |

| | | | 03) Stephen G. Hanks | | 07) Mary Shafer-Malicki | | | | | | | | | | | | | | | | | | | | |

| | | | 04) Stephen M. Johnson | | 08) David A. Trice | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | The Board of Directors recommends you vote FOR the 2009 McDermott International, Inc. Long-Term Incentive Plan.0 0 03.Ratificationfollowing proposals: | | | | | | For | | Against | | Abstain | | |

| | 2. | | Advisory vote to approve named executive officer compensation. | | ¨ | | ¨ | | ¨ | | |

| | 3. | | Ratification of the appointment of McDermott’s independent registered public accounting firm for the year ending December 31, 2009.0 0 0The2012. | | ¨ | | ¨ | | ¨ | | |

| | The shares represented by this proxy when properly executed will be voted in the manner directed herein by the undersigned Stockholder(s).If.If no direction is made, this proxy will be voted FOR ALL for item 1, and FOR items 1, 2 and 3. If any other matters properly come before the meeting, the personpersons named in this proxy will vote in their discretion.Fordiscretion. | | | | | | | | |

| | For address changes and/or comments, please check this0this box and write them on the back where indicated.Yes No indicated. Please indicate if you plan to attend this meeting.0 0Pleasemeeting. | | ¨ | | ¨ ¨ | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | Yes | | No | | | | | | | | | | | | |

| | Please sign your name exactly as it appears hereon. When signing as attorney, executor, administrator, trustee, guardian or guardian,other fiduciary, please add yourgive full title as such. When signing as joint tenants, all parties in the joint tenancy must sign. If a signer is a corporation or partnership, please sign in full corporate or partnership name by duly authorized officer.Signatureofficer. | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Signature [PLEASE SIGN WITHIN BOX]DateSignature | | Date | | | | | | | | Signature (Joint Owners) | | Date | | | | | | | | |

| | | | |

| | McDermott International, Inc.AnnualInc. Annual Meeting Friday, Thursday, May 8, 200910, 2012 at 9:3010:00 a.m. 757 N. Eldridge Parkway, 14thFl.Houston, TX, 77079Dear14th Floor Houston, Texas 77079 | | |

| | | | |

| | Dear Stockholder: McDermott International, Inc. encourages you to vote the shares electronically through the Internet or the telephone, which are available 24 hours a day, 7 days a week. This eliminates the need to return the proxy card.Yourcard. Your electronic vote authorizes the named proxies in the same manner as if you marked, signed, dated and returned the proxy card.Ifcard. If you choose to vote the shares electronically, there is no need for you to mail back the proxy card.Importantcard. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice and Proxy Statement 10-K and Shareholder LetterAnnual Report are available at www.proxyvote.com.IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPEMCDMI2McDermott International, Inc.THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORSANNUAL MEETING OF STOCKHOLDERSwww.proxyvote.com | | |

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG PERFORATION,

DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE

| | | | | | | | | | | | |

| | McDERMOTT INTERNATIONAL, INC. This proxy is solicited on behalf of the Board of Directors Annual Meeting of Stockholders - Friday,Thursday, May 8, 2009The10, 2012 at 10:00 a.m. The undersigned hereby appoints John A. FeesStephen M. Johnson and Liane K. Hinrichs, and each of them individually, as proxies, each with the power to appoint (his/ her)his or her substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of McDermott International, Inc.MCDERMOTT INTERNATIONAL, INC. (“McDermott”), that the stockholder(s) is/are entitled to vote at the Annual Meeting of Stockholders to be held at 9:3010:00 a.m., local time, on Friday,Thursday, May 8, 2009,10, 2012 at 757 N. Eldridge Parkway, 14th Floor,floor, Houston, TX,Texas 77079, and any adjournment or postponement thereof.THISthereof. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE STOCKHOLDER(S). IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE NOMINEES LISTED UNDER ITEM 1 ON THE REVERSE SIDE FOR THE BOARD OF DIRECTORS, AND FOR EACH PROPOSAL.THEOF ITEMS 2 AND 3. THE UNDERSIGNED ACKNOWLEDGES RECEIPT OF MCDERMOTT’S ANNUAL REPORT FOR THE YEAR ENDED DECEMBER 31, 20082011 AND ITSNOTICEITS NOTICE OF 20092012 ANNUAL MEETING AND RELATED PROXY STATEMENT.ATTENTIONSTATEMENT. ATTENTION PARTICIPANTS IN MCDERMOTT’S THRIFT PLAN: If you hold shares of McDermott common stock through Thethe McDermott Thrift Plan for Employees of McDermott Incorporated and Participating Subsidiary and Affiliated Companies (the “Thrift Plan”), this proxy covers all shares for which the undersigned has the right to give voting instructions to Vanguard Fiduciary Trust Company (“Vanguard”), Trustee of the McDermott Thrift Plan. Your proxy must be received no later than 11:59 P.M.p.m. Eastern Time on May 5, 2009.7, 2012. Any shares of McDermott common stock held in the Thrift Plan that are not voted or for which Vanguard does not receive timely voting instructions, will be voted in the same proportion as the shares for which Vanguard receives timely voting instructions from other participants in the Thrift Plan.PLEASEPlan. PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPEAddressCARD ENVELOPE | | |

| | | | | | |

| | | | Address Changes/Comments: (If | | | | | | | | |

| | | | | |

| | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | (If you noted any Address Changes/Comments above, please mark corresponding box on the reverse side.) CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | |

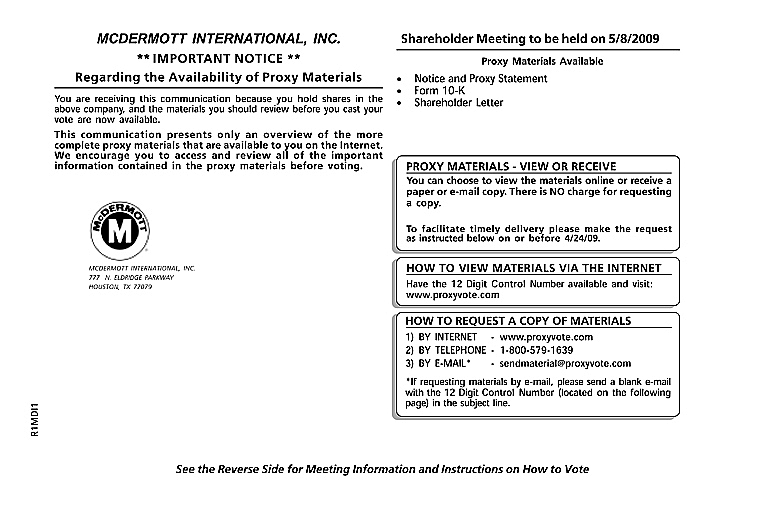

MCDERMOTT INTERNATIONAL, INC. Shareholder Meeting to be held on 5/8/2009 ** IMPORTANT NOTICE ** Proxy Materials Available Regarding the Availability of Proxy Materials• Notice and Proxy Statement• Form 10-K You are receiving this communication because you hold shares in the• Shareholder Letter above company, and the materials you should review before you cast your vote are now available. This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting. PROXY MATERIALS — VIEW OR RECEIVE You can choose to view the materials online or receive a paper or e-mail copy. There is NO charge for requesting a copy. To facilitate timely delivery please make the request as instructed below on or before 4/24/09. MCDERMOTT INTERNATIONAL, INC. HOW TO VIEW MATERIALS VIA THE INTERNET 777 N. ELDRIDGE PARKWAY HOUSTON, TX 77079 Have the 12 Digit Control Number available and visit: www.proxyvote.com HOW TO REQUEST A COPY OF MATERIALS 1) BY INTERNET — www.proxyvote.com 2) BY TELEPHONE — 1-800-579-1639 3) BY E-MAIL* — sendmaterial@proxyvote.com *If requesting materials by e-mail, please send a blank e-mail with the 12 Digit Control Number (located on the following page) in the subject line. R1MDI1 See the Reverse Side for Meeting Information and Instructions on How to Vote |

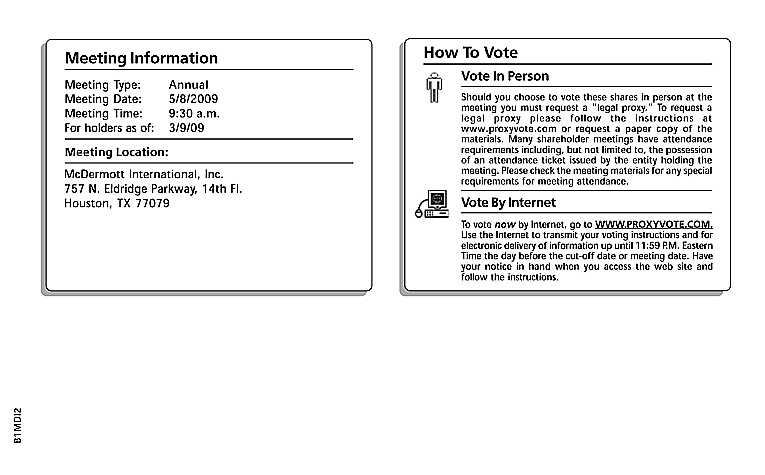

Meeting Information How To Vote Meeting Type: Annual Vote In Person Meeting Date: 5/8/2009 Please check the meeting materials for any special Meeting Time: 9:30 a.m. requirements for meeting attendance. At the meeting, you For holders as of: 3/9/09 will need to request a ballot to vote these shares. Meeting Location: McDermott International, Inc. 757 N. Eldridge Parkway, 14th Fl. Houston, TX 77079 Vote By Internet To vote now by Internet, go to WWW.PROXYVOTE.COM. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on May 7, 2009 (May 5, 2009 for participants in McDermott’s Thrift Plan). Have your notice in hand when you access the web site and follow the instructions. R1MDI2 |

Voting items The Board of Directors recommends a vote “FOR” Items 1, 2 and 3. 1. Election of Directors Nominees as Class I Directors: 01) Roger A. Brown 02) John A. Fees 03) Oliver D. Kingsley, Jr. Nominees as Class II Directors: 04) D. Bradley McWilliams 05) Richard W. Mies 06) Thomas C. Schievelbein 2. Approve the 2009 McDermott International, Inc. Long-Term Incentive Plan. 3. Ratification of appointment of McDermott’s independent registered public accounting firm for the year ending December 31, 2009. R1MDI3 |

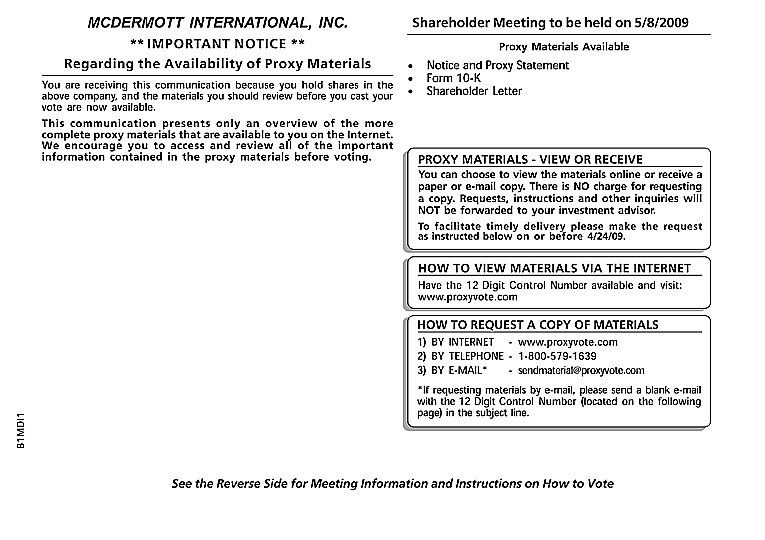

MCDERMOTT INTERNATIONAL, INC. Shareholder Meeting to be held on 5/8/2009 ** IMPORTANT NOTICE ** Proxy Materials Available Regarding the Availability of Proxy Materials• Notice and Proxy Statement• Form 10-K You are receiving this communication because you hold shares in the above company, and the materials you should review before you cast your• Shareholder Letter vote are now available. This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting. PROXY MATERIALS — VIEW OR RECEIVE You can choose to view the materials online or receive a paper or e-mail copy. There is NO charge for requesting a copy. Requests, instructions and other inquiries will NOT be forwarded to your investment advisor. To facilitate timely delivery please make the request as instructed below on or before 4/24/09. HOW TO VIEW MATERIALS VIA THE INTERNET Have the 12 Digit Control Number available and visit: www.proxyvote.com HOW TO REQUEST A COPY OF MATERIALS 1) BY INTERNET — www.proxyvote.com 2) BY TELEPHONE — 1-800-579-1639 3) BY E-MAIL* — sendmaterial@proxyvote.com *If requesting materials by e-mail, please send a blank e-mail with the 12 Digit Control Number (located on the following page) in the subject line. B1MDI1 See the Reverse Side for Meeting Information and Instructions on How to Vote |

Meeting Information How To Vote Vote In Person Meeting Type: Annual Meeting Date: 5/8/2009 Should you choose to vote these shares in person at the meeting you must request a “legal proxy.” To request a Meeting Time: 9:30 a.m. legal proxy please follow the instructions at For holders as of: 3/9/09 www.proxyvote.com or request a paper copy of the materials. Many shareholder meetings have attendance Meeting Location: requirements including, but not limited to, the possession of an attendance ticket issued by the entity holding the McDermott International, Inc. meeting. Please check the meeting materials for any special requirements for meeting attendance. 757 N. Eldridge Parkway, 14th Fl. Houston, TX 77079 Vote By Internet To vote now by Internet, go to WWW.PROXYVOTE.COM. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your notice in hand when you access the web site and follow the instructions. B1MDI2 |

Voting items The Board of Directors recommends a vote “FOR” Items 1, 2 and 3. 1. Election of Directors Nominees as Class I Directors: 01) Roger A. Brown 02) John A. Fees 03) Oliver D. Kingsley, Jr. Nominees as Class II Directors: 04) D. Bradley McWilliams 05) Richard W. Mies 06) Thomas C. Schievelbein 2. Approve the 2009 McDermott International, Inc. Long-Term Incentive Plan. 3. Ratification of appointment of McDermott’s independent registered public accounting firm for the year ending December 31, 2009. B1MDI3 |

Voting items Continued Voting Instructions B1MDI4 |